How much joint mortgage can i get

Lets presume you and your spouse have a combined total annual salary of 102200. With a fixed-rate mortgage youll pay the same interest rate for a set number of years meaning your monthly repayments will remain consistent regardless of what happens to the Bank of England base rate.

Why Buy Real Estate Investing Home Buying Reason Quotes

You can use the above calculator to estimate how much you can borrow based on your salary.

. How Much Mortgage Can I Afford if My Income Is 60000. Borrowers most commonly take. The following table highlights current Redmond mortgage rates.

The longer term will provide a more affordable monthly. The same goes for a co-borrower who no longer wants to be on the line for a mortgage they co-signed. The facts are the same as in Example 1 except that the person who sold you your home also paid one point 1000 to help you get your mortgage.

Find out how much you could borrow for a mortgage. Initiative will focus on building broker channel integration with the leading mortgage broker channel POS solution enabling Doxims Loan Origination System LOS customers to accept deals from. While your personal savings goals or spending habits can impact your.

The mortgage rate you get after a divorce will depend on the same factors that determine other borrowers rates such as your income debt credit score and the market environment. Find out what you can borrow. Reverse mortgage An additional source of income for senior citizens other than the corpus they have amassed can be a reverse mortgage.

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. In the year paid you can deduct 1750 750 of the amount you were charged plus the 1000 paid by the seller. You spread the remaining 250 over the life of the mortgage.

However for the most part when a co-borrower on a joint mortgage dies the mortgage is. This means they can add their income to yours without needing to be named on the property deed or. At 60000 thats a 120000 to 150000 mortgage.

18001 0800 096 9527. 0800 096 9527 Relay UK. Fixed-rate mortgages are the most common type of loan taken out by homebuyers and by homeowners remortgaging.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. The mortgage on the joint tenants interest was a. The only legal way to take over a joint mortgage is to get your exs name off the home loan.

One way you can end a joint tenancy in Florida real estate is to sell your interest in the property to a stranger. By default the table lists refinancing rates though you can click on the Purchase heading to see purchase money mortgages. Factors that impact affordability.

A joint mortgage allows two people to share in the burden and benefits of paying a home loan. When it comes to calculating affordability your income debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

With certain loan programs and lenders it may be possibleespecially if you can make a big down payment prove large cash reserves and have a low. Here a house that the senior citizen owns is mortgaged with a bank which pays a predetermined amount over the period of the mortgage. There are however tax deductions the IRS offers that cover the expenses on up to two homes.

Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage. It is entirely permissible for someone who owns an interest in residential real estate in Florida to sell their interest to anyone of their choosing. In fact some states will have different laws than other states.

You can get in touch over the phone or visit us in branch. And as long as one is your main home and you use the other for personal purposes you can deduct the mortgage interest home equity loan interest through 2017 only and mortgage insurance premium payments through 2021 only you pay on both. Can you get a mortgage if you have bad credit.

You can also input your spouses income if you intend to obtain a joint application for the mortgage. This website provides information on the joint state and federal Settlements involving residential mortgage foreclosures and loan servicing. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Or we can use their annual income on your mortgage application in a joint borrower sole proprietor mortgage JBSP. Each lender and each mortgage agreement will deal with the joint mortgage issues differently. In case of joint applicants the loan can be recovered only after the.

How long will I live in this home. Or 4 times your joint income if youre applying for a mortgage. For information about the settlement for which you may be eligible begin by locating your Mortgage Servicer the entity to which you sent your monthly Mortgage Payments up until your foreclosure from the list below or clicking on the.

Purview On Twitter Refinance Mortgage Mortgage Infographic Mortgage Tips

Invismitweets Making It Happen With The Anatomy Of A Mortgagebroker Mortgage Brokers Mortgage Interest Mortgage Lenders

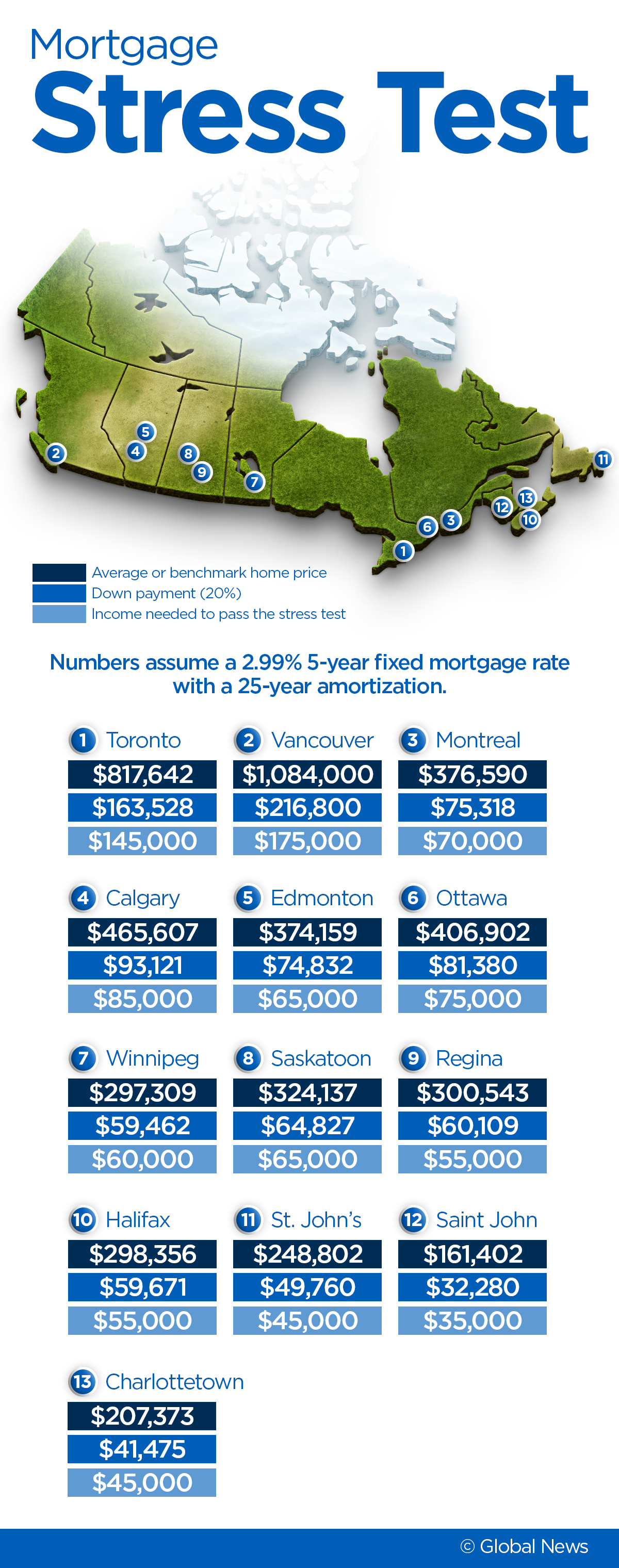

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Joint Mortgages Everything You Need To Know

How We Paid Off 340 000 Mortgage In 3 Years By Saving 86 5 Of Our Income Hishermoneyguide Dr Breathe Easy Finance Debt Free Living Debt Free Money Saving Tips

See Our Reassured Infographic Displaying The Key Differences Between Level And Decreasing Term Lif Life Insurance Facts Best Life Insurance Companies Term Life

Setting Up Digital Financial Binders Financial Binder Money Matters Financial

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

I M 37 My Husband I Make 162 830 A Year We Pay 1 305 A Month For Our Mortgage Food Dinner Lunch

It S Imperative You Work Out Your Requirements And Wants Well In Advance Before You Decide To Rent Or Buy Buying First Home First Time Home Buyers Real Estate

How To Make A Rental Property Business Work Homes Can Be A Much Sweeter Cash Cow Than You Might Have I Credit Debt Refinance Mortgage Mortgage Interest Rates

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

Mortgage Calculator How Much House Can I Afford Mortgage Calculator Mortgage Mortgage Payment Calculator

Mortgage Monkey Flyer Estateagent Property Lifeofanagent Mortgage Marketing Reverse Mortgage Mortgage

Pin On Commercial And Residential Hard Money Loan In New Jersey

Budgeting For Couples How To Budget As A Couple Budgeting Debt Solutions Money Management Advice

29 Ways It Pays To Work With A Realtor Real Estate Finance Blog Real Estate Buying

Komentar

Posting Komentar